TGS Cloud -Based Backtesting

-Based Backtesting

Unleashes Efficiency and

Accuracy with Innovative

Technology"

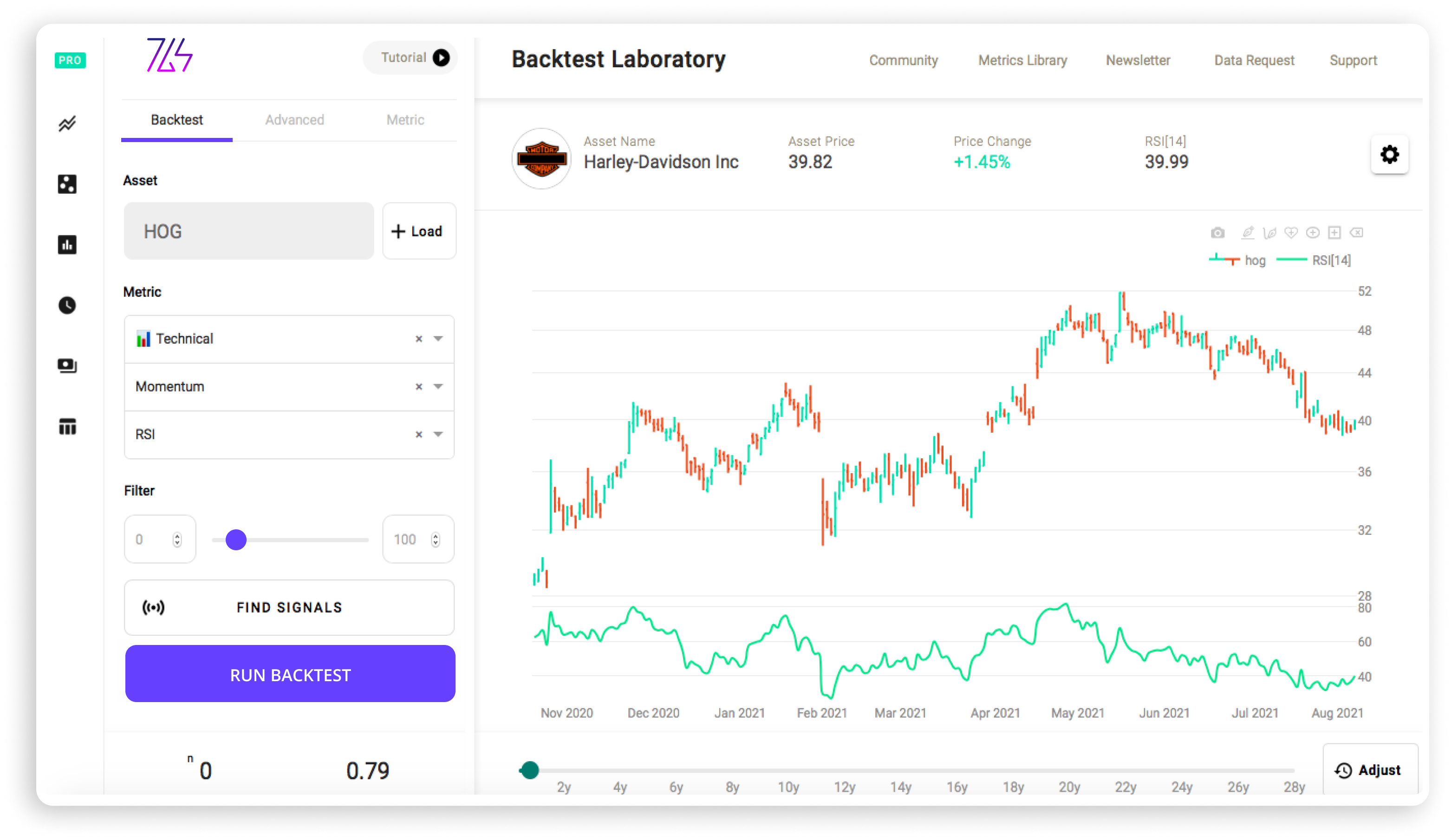

"Revolutionizing Trading Strategies: TGS Cloud-Based Backtesting Unleashes Efficiency and Accuracy with Innovative Technology"

Why TGS Cloud-Based Backtesting Technology

Key Points About TGS Cloud Based Technology

Testing 100 Different Securities

Empower your strategies with our cloud-based system, conducting simultaneous backtesting on 100 securities with hundreds of parameter combinations. Our robust capabilities extend into the millions, offering a comprehensive analysis for unparalleled strategy refinement.

3 minutes of computation

TGS's cloud-based backtesting excels in efficiency, delivering results in just 3 minutes. Harnessing cloud computing, we transform traditional approaches by concurrently testing millions of parameters.

Effective Parameters

Our technology doesn't just backtest; it optimizes. We enable traders to find the most effective parameters for their strategies, ensuring higher accuracy and better trading outcomes.

Cloud-Based Backtesting Strategies

In technical analysis, RSI, MACD, Moving Average, Bollinger Bands (BB), and EMA are vital indicators offering diverse insights. From momentum to volatility, these tools provide a concise yet powerful toolkit for effective market analysis.

Our Strategies

RSI- Relative strength index

The Relative Strength Index (RSI) is a popular momentum oscillator used in technical analysis that measures the speed and change of price movements. RSI oscillates between zero and 100 and is typically used to identify overbought or oversold conditions in trading assets. Here’s a basic guide on how to use the RSI strategy in trading: